Day trading in Forex has become a popular avenue for investors seeking to capitalize on short-term market movements. With its high volatility and liquidity, Forex trading provides numerous opportunities for profit within a single trading day. For those who are new to this dynamic world, it is essential to familiarize yourself with the key concepts, strategies, and best practices that can help you become a successful day trader. If you are considering day trading, it’s crucial to research reliable platforms and brokers. You can start by exploring the day trading in forex Best Cambodian Brokers available in your region, as selecting the right broker is a vital step towards ensuring a seamless trading experience.

What is Day Trading?

Day trading involves buying and selling financial instruments within the same trading day. In the Forex market, this usually means taking advantage of small price movements in currency pairs to make a profit. Unlike long-term investors who hold assets for months or years, day traders focus on making quick profits from short-term market fluctuations.

Understanding Forex Market

The Forex (foreign exchange) market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. It operates 24 hours a day due to the global nature of currency trading, which allows traders to engage at any time. The Forex market is driven by various factors, including economic indicators, geopolitical events, and shifts in market sentiment, making it essential for day traders to stay informed about global developments.

Essential Strategies for Day Trading Forex

Successful day trading in Forex is built on a foundation of sound strategies. Here are some of the most popular approaches:

1. Scalping

Scalping is a strategy that focuses on making small profits from minor price changes. Traders who use this method execute multiple trades throughout the day, holding positions for only a few seconds to minutes. Scalping requires quick decision-making, a solid understanding of market dynamics, and the ability to manage leveraged positions effectively.

2. Momentum Trading

This strategy involves identifying currency pairs that are moving significantly in one direction and capitalizing on that momentum. Traders typically rely on technical indicators, such as moving averages and volume, to confirm the strength of the trend. Momentum trading requires traders to act quickly, as trends can reverse rapidly.

3. Breakout Trading

Breakout trading involves identifying key support or resistance levels and entering a trade once the price breaks through those levels. This strategy assumes that the price will continue to move in the direction of the breakout, leading to potential profits. Traders often use various indicators, such as Bollinger Bands or trendlines, to identify breakout opportunities.

Key Tools for Day Traders

Day traders rely on various tools and technologies to aid their trading. Here are some essential tools you should consider:

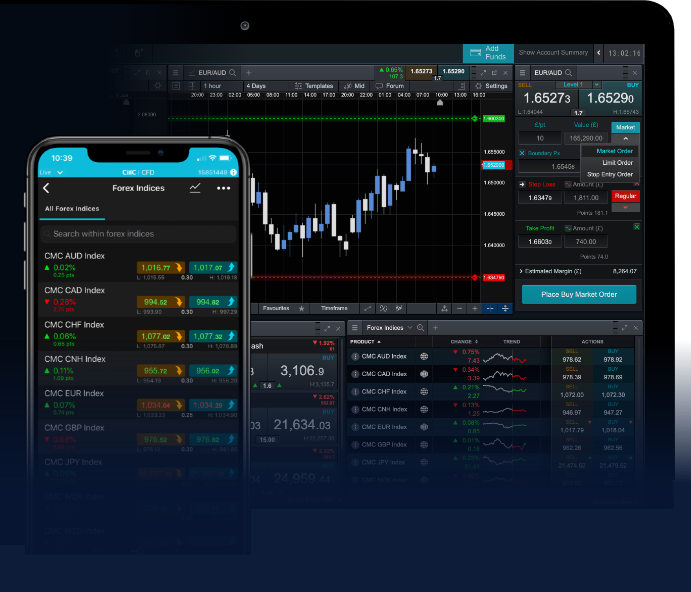

1. Trading Platform

A reliable trading platform is crucial for executing trades quickly and efficiently. Choose platforms that offer advanced charting tools, customizable interfaces, and access to live market updates. Many brokers provide their own trading platforms, while others support third-party platforms like MetaTrader 4 or MetaTrader 5.

2. Technical Indicators

Technical indicators such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and moving averages help traders analyze market trends and make informed decisions. Learning how to use these indicators effectively can significantly enhance your trading strategy.

3. Economic Calendar

An economic calendar lists important economic events, such as interest rate decisions or GDP releases, that can impact currency prices. Staying updated with these events allows traders to anticipate market volatility and make informed trading decisions.

Risk Management in Day Trading

Effective risk management is crucial for day traders, as losses can accumulate quickly. Here are some strategies to help manage your risk:

1. Set Stop-Loss Orders

Always use stop-loss orders to limit potential losses. A stop-loss order automatically closes a trade when the price reaches a predetermined level, helping to protect your capital.

2. Define Your Risk Percentage

Determine the percentage of your total capital that you are willing to risk on each trade. Many traders recommend risking no more than 1-2% of their capital on a single trade. This approach allows you to withstand a series of losses without significantly jeopardizing your trading account.

3. Diversify Your Trades

Avoid putting all your capital into a single position. By spreading your trades across multiple currency pairs, you can reduce the impact of adverse price movements on your overall portfolio.

Psychology of Day Trading

The psychological aspect of day trading cannot be overstated. Emotions like fear and greed can lead to impulsive decisions and substantial losses. Here are some tips for maintaining a disciplined mindset:

1. Stick to Your Plan

Develop a comprehensive trading plan that outlines your strategies, risk tolerance, and goals. Adhere to this plan and avoid making emotional decisions based on market fluctuations.

2. Accept Losses

Losses are an inevitable part of trading. Accepting losses gracefully and analyzing what went wrong can help improve your trading skills over time.

3. Stay Calm and Focused

Day trading can be stressful, especially during high volatility periods. Practice stress management techniques, such as deep breathing or taking breaks, to maintain your focus and composure.

Conclusion

Day trading in Forex can be a lucrative endeavor for those willing to invest time and effort into learning the necessary skills. By understanding market dynamics, adopting effective strategies, utilizing essential tools, and practicing sound risk management, you can enhance your chances of success. Remember that continuous education and emotional control are vital components of a successful trading career. Consider starting your day trading journey by researching the Best Cambodian Brokers to find the right partner to facilitate your trading activities.